Financial Planning

Each family is unique and so are the factors that shape your financial plan. Our approach is to create a personalized roadmap tailored to your values and goals.

How can I have confidence that my money won’t run out during my retirement?

Financial Planning

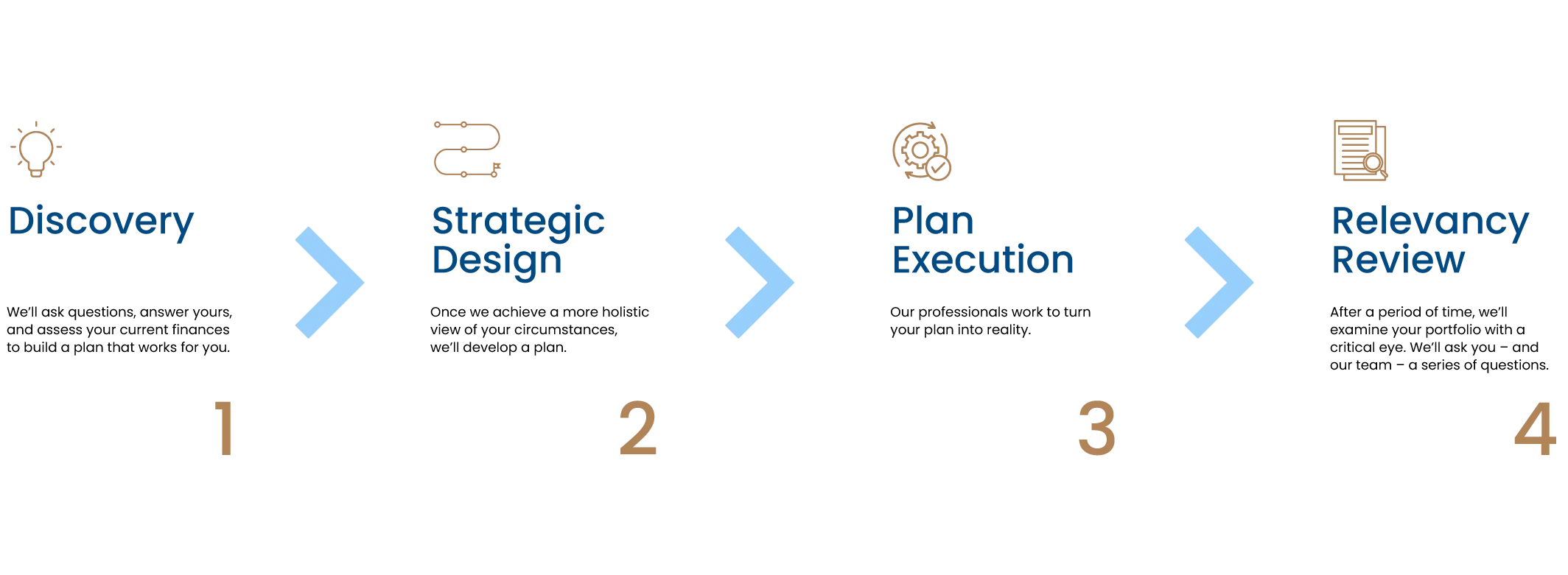

Each family is unique and so are the factors that shape your financial plan. At Capital Wealth Advisors, we use a four-step approach to create a personalized roadmap tailored to your values and goals.

Learn how we work to give your family a brighter today and tomorrow.

Phase 1: Discovery

During this phase, your advisor will work to understand what’s most important to you. Who do you cherish? What are the deeper motivations, facts, and circumstances that brought you here today? How can we help you protect the future you envision?

We’ll ask questions, answer yours, and assess your current finances to build a plan that works for you.

- Goal-Based Cash Flow and Budgeting: Understanding your financial situation is key to crafting a strategy that meets your goals. This involves assessing your family’s assets spending habits, income, expenses, debt commitments, and potential impacts of new liabilities. We will engage with your family’s legal or tax professionals.

- Simulated Investment Outcomes and Risk Analysis: In addition to daily finances, we’ll examine your current investment portfolio – from retirement accounts to personal holdings – and help you allocate assets thoughtfully. This process may include conducting risk analyses and simulating investment outcomes to ensure a robust strategy.

Phase 2: Strategic Design

Once we achieve a more holistic view of your circumstances, we’ll develop a plan that considers the ever-changing landscape of financial markets, tax regulation, and risk management in the context of your family’s goals.

- Retirement Transition Planning: We help you prepare for the shift from an active working life to retirement. This involves analyzing whether income sources can sustain your desired lifestyle throughout retirement.

- Maximizing Social Security: We create a customized plan considering your age, life expectancy, and other income, to make informed decisions about your financial future.

- College Planning: We help you develop a tailored strategy to save for your children’s and/or grandchildren’s education. We consider factors like tuition costs and investment options to set them on the best path forward.

- Planning for Divorce or Loss: We offer thoughtful guidance to help you navigate difficult transitions and protect your family’s wealth.

Phase 3: Plan Execution

Once we have the information we need, we are ready to put your plan in action. With your advisor at the helm we work to coordinate all the aspects of your plan.

Phase 4: Relevancy Review

With decades of wealth management experience, we understand how much can change over the course of a month, a year, or 10 years. We think the best outcomes are when we collaborate with clients and their whole financial team.

After a period of time, we’ll examine your portfolio with a critical eye. We’ll ask you – and your team – a series of questions:

- How can the plan be better?

- Are your goals still what they were?

- Is this still the best way to achieve them?

- What changes in your life, needs, or family should now be contemplated?

- What future goals and changes do you anticipate?

These answers help us determine the best path forward for your family and your wealth.